What Is the Average Lifespan of a Vehicle Engine?

When you purchase a previously owned vehicle, you have to take a number of different factors into account. Things like the accident history, prior parts replacement, the age of the car, mileage and the overall condition of the car are all elements that you will likely want to know more about before you make a final decision to buy a vehicle. One important consideration is the condition of the engine and how many miles are on the car. While engine longevity can range widely depending on the make, model, age and condition of the vehicle, there are certain factors and guidelines that you can keep in mind when trying to determine the lifespan of a vehicle’s engine.

Factors that contribute to engine longevity

There are a multitude of things that impact the longevity of the engine. In some cases, the area where you live might cause your engine to wear down more rapidly. If you live up a steep hill, for example, or if you have to pass over rough terrain on a regular basis, your engine will undergo more stress and will likely not last as long as it would if you were usually driving on flat, smooth roads.

The type of car that you have is also an important consideration. Generally speaking, heavy duty trucks won’t last as long as smaller cars do. Additionally, the amount of effort that you put into maintaining your car will greatly influence what you can expect to get out of it. If you perform all of your routine maintenance on time, take your car in to be serviced regularly and make any necessary engine repair

Top 5 Symptoms of Your Car Needing an Oil Change or Tune-up

There are so many different signs and symptoms that will show up and indicate your car needs an oil change and possibly a tune-up (see below for what a tune-up actually means).

When you take your vehicle in for an oil change, the service person will perform an oil and oil filter change as well as inspect your vehicle for leaks and other noticeable issues and then give you additional recommendations on what they think needs to be done.

However, you shouldn’t always depend on them to do this accurately because they might not always catch every issue. This is why you need to pay attention to the signs which indicate that you also need a tune-up of some sorts.

Below are the top 5 signs of your car needing an oil change and/or a tune-up.

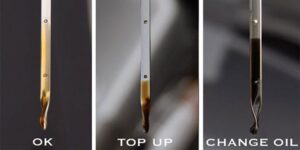

#1 – Dark or Dirty Oil

If you’ve never seen clean, new motor oil before, it kind of has a bright amber color to it. But when oil becomes old and dirty from the build-up of residue particles in the engine, then it turns into a much darker, almost black color.

You should make it a habit checking the condition of your oil on a regular basis. Simply remove your oil dipstick and look at the color of the oil on it. Or wipe the end of the dipstick on a paper towel to get a more accurate result. If the oil is dark brown or black, then you need to change your oil.

#2 – Ticking or Tapping Noises

Engine oil gets old and worn after a while. That is why car manufacturers recommend you change your oil every 5,000 miles or so. If you have old oil in your vehicle, then it is likely getting dirtier and thicker.

This will make it harder for the oil to lubricate your engine’s components effectively. As a result, your engine will begin making various metal on metal noises because they are not getting lubricated properly. Get an oil change right away as serious engine damage can result if you ignore the issue.

#3 – Burnt Oil Smell

If the interior cabin of your vehicle is starting to smell like burnt oil, then you know you have some problem with your oil. It usually means there is an oil leak somewhere and causing the oil to drip on hot engine parts.

It also means your engine is likely low on oil and causing your engine to overheat. Take care of the oil leak right away and put in fresh oil.

#4 – Exhaust Smoke

If you live in a cold environment then you are used to seeing vapor emitting from the tailpipe of your vehicle. However, if you actually start seeing blue or gray smoke come out of your exhaust, then you probably have an oil leak.

This goes along with a burnt oil smell and the smoke is the result of not enough oil being in your engine to lubricate its parts, due to the leak. So, get that oil leak fixed and the oil replaced.

#5 – Car Stalling

If you’re driving and your vehicle begins to stall, then you could have a small problem or a bigger issue. A small problem would be if you have a clogged fuel filter or bad spark plugs. Something like this can be replaced with a simple tune-up. A larger problem would be something like a bad fuel pump or clogged catalytic converter which need replacing.

Signs your battery is about to die

Your car battery is responsible for powering your car’s computer, ignition system, lights, radio and more, so it’s important to monitor its condition to avoid getting caught out. A recent study showed that more than 1 in 10 car batteries need replacing.* Problems can happen almost without warning, however, there are a few key signs to look out for when checking if a car battery is dead.

- Difficulty starting the car

Your car requires a huge surge of energy to start the engine. With a failing battery, you’ll notice that the engine cranks more slowly than usual, and the car takes longer to start. You’ll often only get one or two warning signs of this nature before the battery completely dies, so don’t ignore it. If, when turning the key, you hear a clicking sound, there is not enough power to crank the engine at all. If this is the case you’ll need to jump start your battery and get a new battery fitted as soon as possible.

- Low/loss of power to electrics

Your car’s battery not only starts your engine – it also powers the various electronics inside your vehicle such as electric windows, lights, heaters and seats. A loss of electrical power is typically more noticeable in colder months, when these systems are running more than normal.

- Dashboard warning symbol

An illuminated battery symbol could be down to a loose starter terminal, a failing alternator or even damaged cabling. If the light stays on while driving, there’s likely a problem with your alternator belt (responsible for charging your battery while on the move). This shouldn’t be overlooked – a faulty charging system could leave you stranded.

Signs to tell if your spark plugs need to be replaced

VISUAL INSPECTION

Remove and compare your old spark plugs to a new one. If the tip and/or electrode show excessive wear they should be replaced. Also, look for fuel and oil contamination. If contamination is found, the spark plugs should be replaced. However, additional inspection is needed to determine the cause of the contamination whether it is caused by oil, fuel, or coolant. Failing components within the engine itself can cause oil or coolant contamination. Fuel contamination can be caused by failing components within the fuel, ignition and/or emission systems.

Pro Tip: The following are symptoms that may occur with worn spark plugs. Keep in mind, there may be other issues causing the problem. Be sure and do a complete inspection before replacing any parts.

TROUBLE STARTING

If you are experiencing what seems to be longer cranking times, especially on a cold morning, you’ll want to look at your spark plugs and related ignition and fuel system components. Over time, spark plugs develop residue from unburnt gases and oils, which reduces your car’s performance and makes cold-starting more difficult. Tough cold starting is not only bad for your engine, but can also drain the battery and increase starter wear and tear.

ROUGH IDLING

If your vehicle’s engine is running rough or noisy when idling, you may have a spark plug issue. Heavy rumbling when waiting at a stoplight or in a drive-thru may indicate your car is overdue for maintenance. Inspect the spark plugs and replace accordingly. Replacing the spark plugs, and potentially also the ignition coils and wires, may solve this.

MISFIRING

Misfires are hard to miss, as the engine will shake so badly that you’ll feel the vibration throughout the car. Misfiring results in poor performance, reduced fuel economy, increased emissions, and rough idling. Replacing spark plugs may help with this issue but inspect them first.

DECREASED FUEL MILEAGE

Low gas mileage is a subtler sign of worn spark plugs. Deteriorated spark plugs can account for as much as a 30-percent loss in fuel economy, which you’ll definitely feel at the pump and your wallet. If you’ve checked and determined the fuel mileage has dropped, check your spark plugs and related items for signs of wear.

How long will a car battery last?

Car batteries are designed to last between 3 and 5 years. All of our batteries come with a 3, 4 or 5 year guarantee, so in the unlikely case your battery fails, we’ll replace it for free.

How much does a new battery cost?

The cost of a new, fully fitted car battery depends on the type of car you drive. For example, a car that is start/ stop enabled will need a specific type of battery. Our prices start from just £49 (including fitting) and our technicians will always provide you with a quote upfront